The analyst hiked his price target to $400 from $330. It also signals Microsoft is well-situated to capture value created through generative AI, he added. While the Copilot offering represents a "significant premium" to Microsoft 365 and came in higher than some analysts expected, Atlantic Equities' James Cordwell views it as a sign of the company's confidence in the product and demand. The analyst has an overweight rating on the stock and raised his price target to $385 per share from $350. "Consistent with our note … on a recent AI discussion held by Amy Hood, EVP & CFO at Microsoft, we reaffirm our extreme bullish-outlier viewpoint on Generative AI and walk away incrementally positive on Microsoft's category leadership in AI as we believe it has reached 'escape velocity' in this market," wrote JPMorgan analyst Mark Murphy in a Wednesday note to clients.

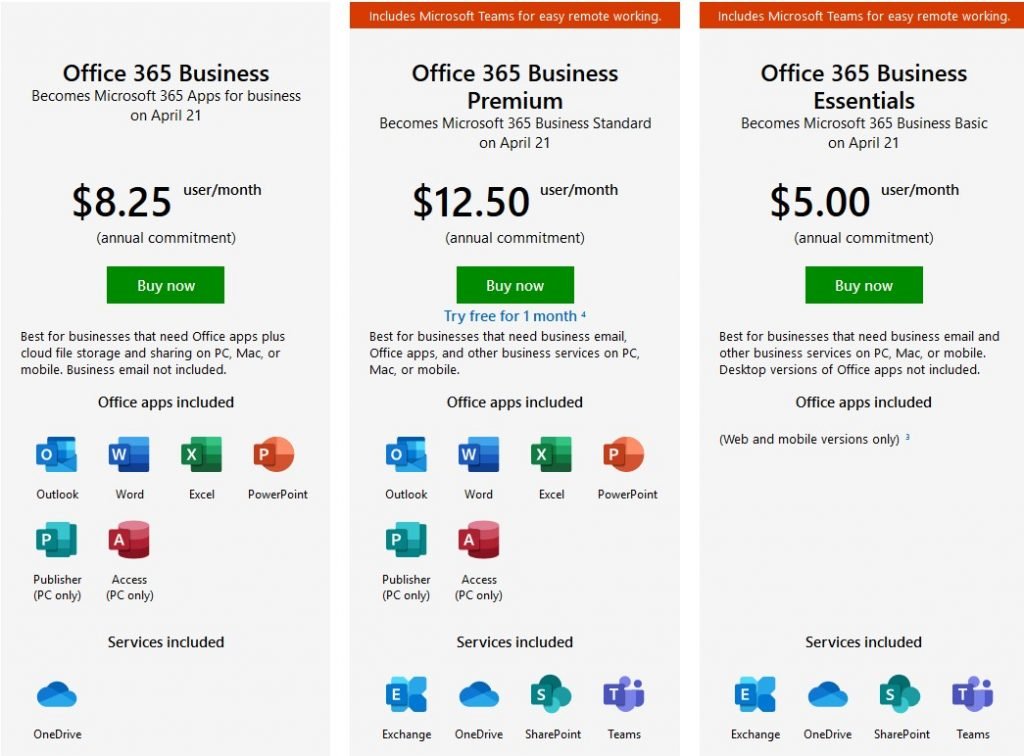

Microsoft has been at the forefront so far, with its multibillion-dollar investment in ChatGPT-maker OpenAI. The announcements led to a handful of Wall Street price target adjustments, as the company solidifies its dominance in the latest technology revolution consuming the investing community. The company also shared a significant update to its Bing AI chatbot and said it would offer Meta Platform's new large language model to Azure customers. Shares closed at a record Tuesday after Microsoft revealed a $30 fee for its monthly Copilot offering, which adds AI capabilities to Microsoft 365. Personal Loans for 670 Credit Score or LowerĪnalysts are turning more bullish on Microsoft and its artificial intelligence capabilities after the software giant revealed pricing for its AI subscription service. Personal Loans for 580 Credit Score or Lower Best Debt Consolidation Loans for Bad Credit

0 kommentar(er)

0 kommentar(er)